Estate Agency

Nottingham House Prices 2022

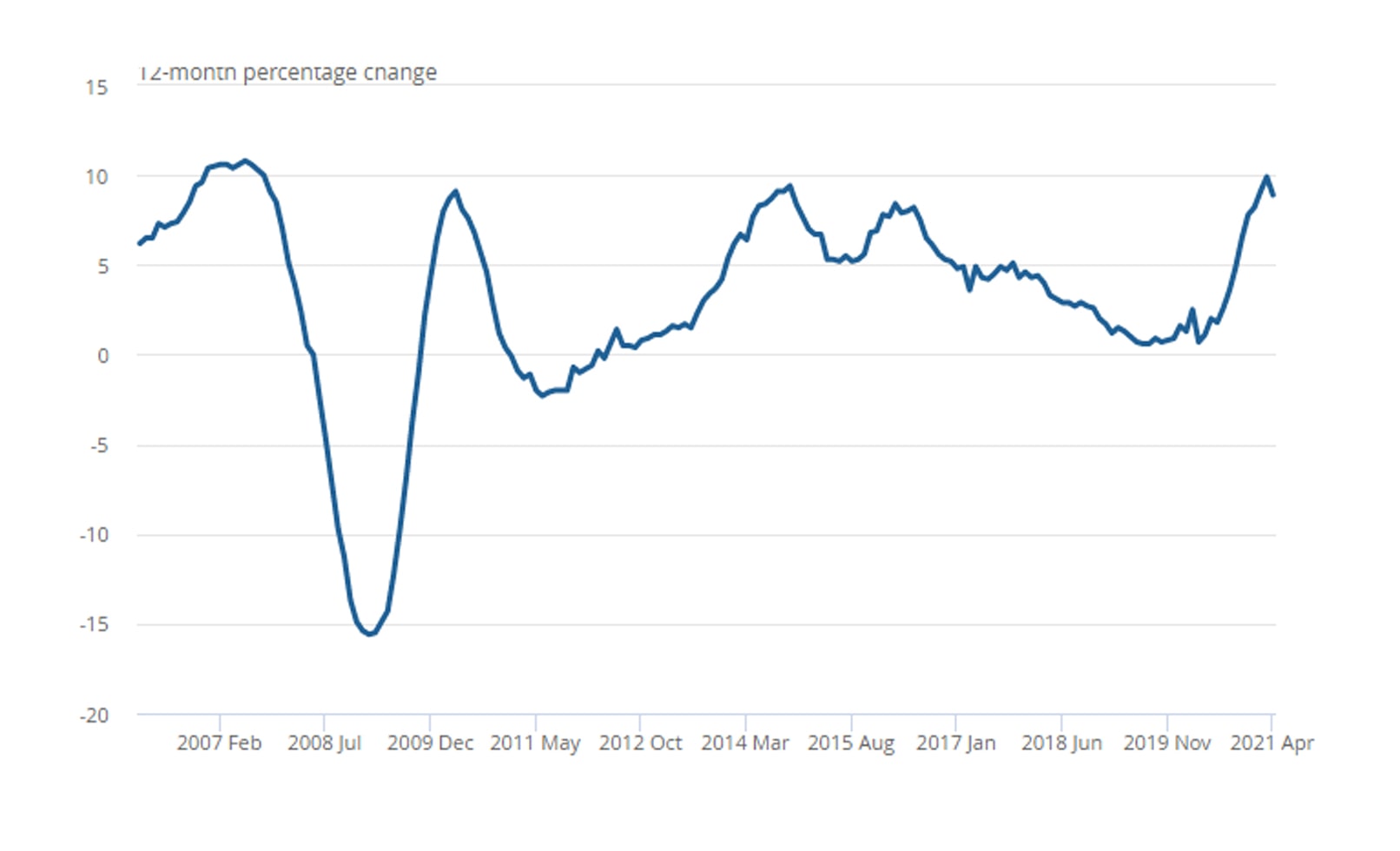

House prices see strongest rise since 2007

House prices 13 per cent higher than pre-pandemic levels

Eviction rule changes

Rightmove’s busiest day in history March 2021

Stamp duty holiday set to be extended

Walton & Allen featured in Best Estate Agent Guide

New 2020 Help To Buy scheme announced