Blog

Awarded Best Letting Agent in NG1, Nottingham

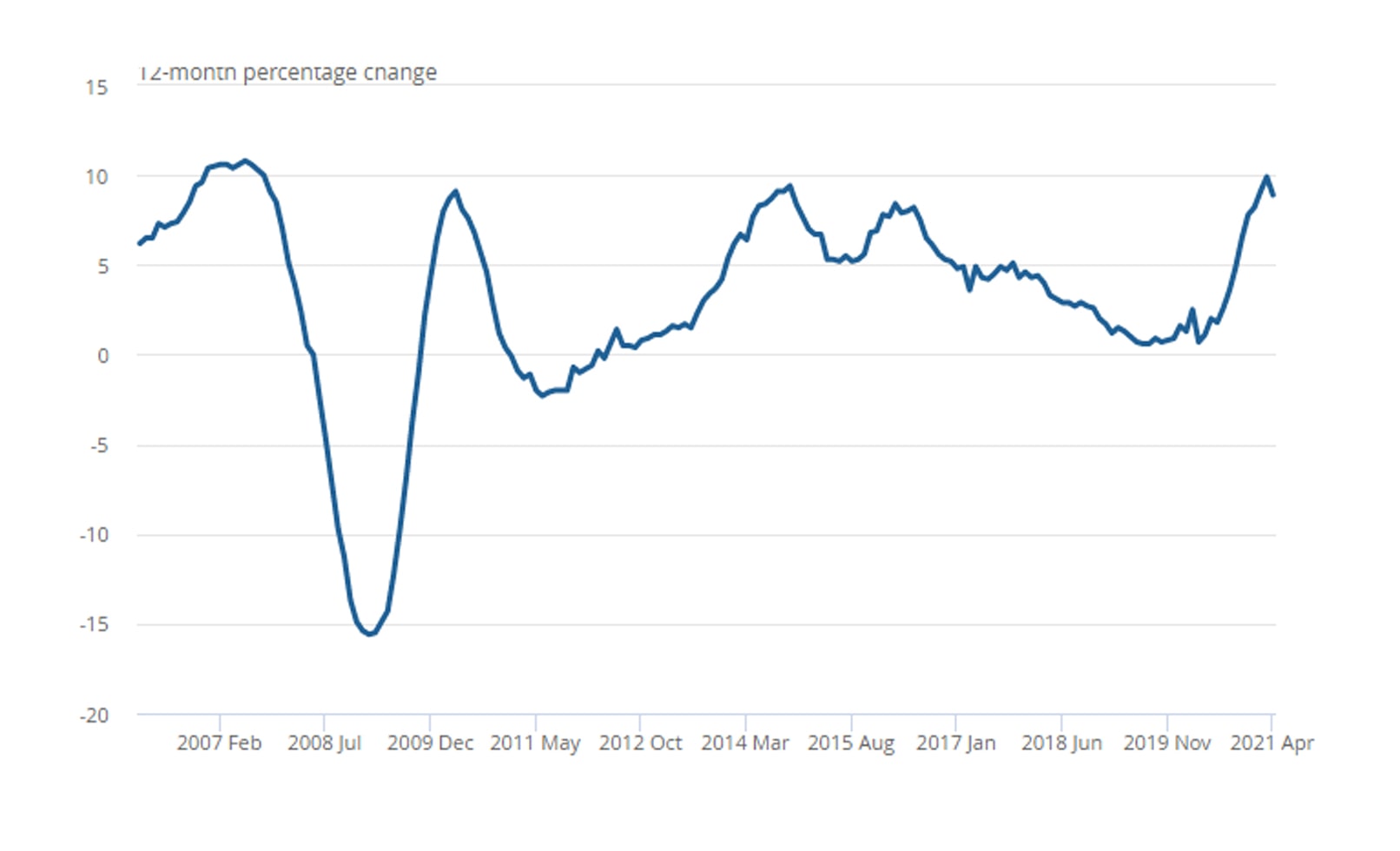

House prices see strongest rise since 2007

Lettings notice period length changes

House prices 13 per cent higher than pre-pandemic levels

Nottingham Selective Licensing: What you need to know

Nottingham Selective Licensing Update 2021

Blog Mortgage & Financial Services

Free Mortgage Broker in Nottingham

Eviction rule changes