Mortgage rates at an all time low

Posted on June 1, 2017 by Paul Meakin

According to the Daily Mail, official figures state mortgage rates have hit the lowest on record.

Experts explained this could be due to the collapse of the buy-to-let market after tax hikes on second properties and this could have made lenders desperate for new business.

Lowest mortgage rates

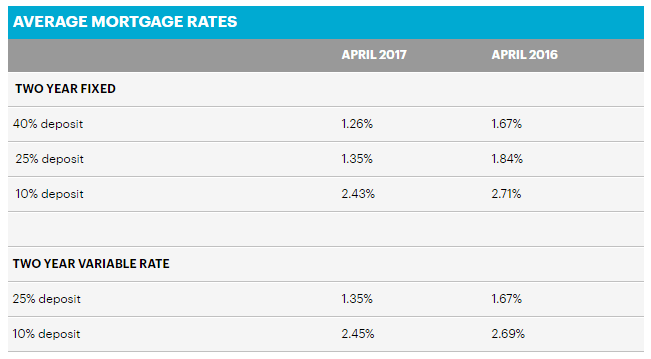

If you didn’t know already, mortgage rates have launched which are now below 1%. This has had a knock on effect on average rates, with popular two-year fixed-rate deals down now to just 1.26%.

This particular example would work for anyone with a 40% deposit and would see monthly repayments on a £150,000 mortgage drop, saving around £400 per year.

If you don’t have a 40% deposit then this wouldn’t be the deal for you, however other deals which are applicable should also have seen a fall in rates.

Looking at your own mortgage deal

This is obviously a great time for both first time buyers and for those who have been on the same mortgage deal for a while. According to The Mail, experts say now is the perfect time to look for the best deal, especially those who have been on a 3-6% rate. You’re effectively ‘throwing your money down the drain’.

Independent mortgage broker, Paul, says ‘now is possibly the best time to look as we have never seen rates as good as this. Even if you can’t get the absolute cheapest deal, using a broker such as myself will help to find the best one specific to your financial situation. It’s possibly a once in a life time opportunity!’.

Fill in the form below to speak with an independent mortgage broker, free of charge

A mortgage is a loan secured against your home. Your home may be repossessed if you do not keep up with repayments on your mortgage. Think carefully before securing a debt against your home.

Read more about our Financial Services.

What is your home worth?

Book a valuation

Get a free mortgage advice appointment

See how much I can borrowProperty market insights